How to buy commercial fleet auto insurance for vans.

Introduction

One of the most important investments a business owner can make is in commercial fleet auto insurance for vans. Purchasing commercial fleet auto insurance is one of the necessary steps to ensure your business and its assets are protected in the event of an accident. Commercial fleet van insurance provides financial protection against damage to property, medical expenses, and liability claims caused by an accident involving the insured vehicle. Buying commercial fleet auto insurance for vans can be a complicated process depending on the size of the fleet and the driver’s experience. This document will provide a comprehensive guide to buying van insurance for businesses with fleets of up to 40 vans.

Request help with insuring your fleet of Vans.

Getting Started

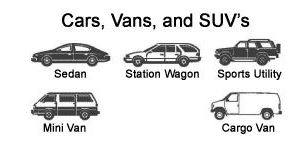

The first step in purchasing commercial fleet auto insurance for vans is determining the size and type of fleet to be insured. Most large insurance companies offer policies for fleets of two or more vehicles, but if a business has fewer than two vehicles, it may be necessary to purchase separate policies for each. It is also important to consider the types of vehicles in the fleet. If a business operates a variety of vans and trucks, it may be beneficial to insure them all under the same policy. In addition to the number and types of vehicles, it is essential to determine how much coverage is needed for each vehicle and the budget available.

Factors Affecting Commercial Fleet Auto Insurance Rates

When it comes time to buy a van insurance policy, there are several factors that can affect commercial fleet auto insurance rates. The primary factor is the size of the fleet and the number of vehicles that are being listed on the policy. Insurance companies typically charge higher premiums for larger fleets due to the greater risk posed by having multiple vehicles on the road simultaneously. Drivers’ histories can also have an effect on rates; drivers with a history of traffic violations, at-fault accidents, or tickets will typically have higher rates than those with clean driving records.

The type of vehicles in a commercial fleet can also play a role in determining rates. Some makes and models are considered higher risk than others, and these vehicles may require higher premiums in order to properly cover their costs in the event of an accident. Additionally, if a business operates older vans with higher-than-average mileage or wear-and-tear, insurers may charge higher rates to cover their expected repair costs.

Finally, where a vehicle will be driven can affect commercial fleet auto insurance costs. Insurers often tailor premiums to accommodate the risks associated with different geographic areas, such as increasing rates for businesses whose vans primarily operate in high-traffic urban locations as opposed to rural areas.

Choosing an Insurer

The next step in purchasing van insurance for businesses with fleets up to 29 vehicles is selecting an insurance provider. When selecting an insurer, it is important to take into account factors such as customer service policy, coverage options available, and discounts offered. Most large insurance companies have dedicated customer service departments that can help answer any questions customers may have about their policies, as well as provide support after an accident or claim has been filed. It is also important to evaluate coverage options available through each insurer; while most insurers offer similar offerings, some may provide additional coverage options such as breakdown assistance or roadside assistance that could make them more attractive from a price perspective. Finally, businesses should make sure to inquire about any discounts or incentives offered by insurers; most major insurers offer discounts for insuring multiple vans or for having multiple policies with them (such as for both workers’ comp and auto), which can reduce overall costs significantly.

Decide Coverage Level

Once an insurer has been selected, it is time to decide on a coverage level for the commercial fleet auto policies being purchased. Commercial fleet auto policies typically include liability coverage, which provides protection against property damage and bodily injury claims stemming from an accident involving one of the insured vehicles; collision coverage, which covers repair costs resulting from an at-fault accident; comprehensive coverage, which covers damages resulting from incidents other than accidents; uninsured motorist coverage, which offers protection against damages caused by uninsured drivers; and personal injury protection (PIP) coverage, which provides medical benefits for injuries sustained in an accident regardless of who was at fault.

Choosing a coverage level for each type of coverage will depend on several factors such as budget, risk profile of drivers in the fleet, and driving conditions where vehicles routinely operate (e.g., high-traffic urban areas may require higher levels of liability coverage due to an increased risk of accidents). Most insurers offer customizable coverage levels so businesses can select the option that best fits their budget and needs. It is important to note that most states have minimum requirements for liability coverage; businesses should make sure they are meeting these minimums before signing off on any policy.

Finalize Policy Terms

Once all elements of a van insurance policy have been decided on, it is time to finalize all details and sign off on the policy forms. Most insurers require businesses to provide proof of ownership when signing off on van insurance policies; this can usually be done through providing registration documents or VIN numbers for each vehicle being insured. Additionally, most insurers require customers to pay for their policies upfront or spread out payments over a period of months; businesses should make sure they understand payment terms before signing off on a policy so they know what type of payment schedule works best for their business’s budget.

Conclusion

Buying commercial fleet auto insurance for vans can be a complex process depending on the size and type of fleet being insured as well as any past driving violations associated with drivers operating in the fleet. Understanding factors such as size/type/number of vehicles in the fleet, budget available for coverage levels, insurance provider offering desired services/discounts/incentives, state law requirements associated with vehicle registration/ownership/liability coverage limits, and payment terms associated with finalizing the policy forms is key to selecting an appropriate van insurance policy that meets both legal requirements and budget needs. Following this guide will ensure business owners have an understanding of all purchasing considerations when deciding on what type of van insurance best fits their business’s needs.